“‘This is ridiculous,’ said Criley, 55, who pulled into a Valero station off Hamilton Avenue in San Jose where gas was selling for $4.61 a gallon. A station attendant told him that he had just raised the price 20 cents five minutes earlier. ‘It had been holding at $3.99 for a couple of weeks. Now this. You betcha this hurts.'”-The Oakland Tribune, 04 October 2012

“Gasoline station owners in the Los Angeles area including Costco Wholesale Corp. are beginning to shut pumps because of supply shortages that have driven wholesale fuel prices to record highs.”-Bloomberg, 04 October 2012

“The U.S. average retail price of regular gasoline decreased five cents last week…Prices decreased in all regions of the Nation except the Rocky Mountains….The national average diesel fuel price decreased a nickel…”-U.S. Energy Information Agency, 26 September 2012

So, in September average retail fuel prices slightly decreased. In some places, like Idaho, per gallon Diesel (distillate fuel oil, DSO) prices held almost steady while gasoline went down a piddly few cents. Now prices are already going back up.

Do not blame the gas station operators!!! I managed a gas station in Santa Maria, California, decades ago, and I can tell you the profit margin is just too small at the retail level. In fact, the current situation in California is shutting down family owned gas stations: “Gas is costing me almost $4.75 a gallon with taxes. There’s no sense in staying open. The profit margins are so low it’s not worth it.”-Sam Krikorian, owner Quality Auto Repair in North Hollywood

A Montana based petroleum industry analysts agrees: “The mom and pop gas stations are having to close down from either not being able to obtain gasoline from their regular distributor or cannot afford the break-even price of almost $5 per gallon!”-Bob van der Valk

Back at the beginning of September I warned of higher fuel prices for October. This was based on the futures (commodity) prices of fuel, which are usually four weeks out. I basically warned that on 12 October 2012, DSO fuel prices could hit around $5.15 per gallon!

I also explained that fuel prices in the Petroleum Administration for Defense Districts (PADD) 5 area (Alaska, Arizona, California, Hawaii, Nevada, Oregon, Washington) was being hit by fuel refinery shut downs, for reasons known and unknown (and so is the rest of the country). It looks like that situation has not changed, and might actually be worse on the east coast and along the Gulf of Mexico!

Several media sources are reporting that California fuel refiners are actually rationing out fuel! The result is that gasoline is reported to have jumped by a full dollar in one week in some parts of the Los Angeles area!

Phillips 66 is shutting down two California refineries for maintenance. A Chevron pipeline was shut down because of contamination. On 01 October, a ExxonMobil refinery was shut down because of a power outage. And according to a Bloomberg report, the narcissistic environmental policies created by California politicians/environmentalists have made it impossible to import fuels from outside California!

So don’t blame Obama! Obama has allowed the opening of more oil fields than any other U.S. President (a true oil man)!!! It’s the fault of the oil companies and fuel refiners, and stupid laws in California! And that’s the real crux for the drivers in California, the stupid laws!

Even though California is part of PADD 5, their fuel refining laws are so strict that fuel made outside California, yet still within PADD 5, can not be sold inside California!!!

Oh, and the prices Californians are seeing now don’t even reflect what the gas station owners are paying: “Really, since the Chevron Richmond fire, inventories have been tight. As other refinery problems occur, there isn’t much or any available inventory. Retailers are not yet reflecting the wholesale price increases they have experienced...”-Tom Robinson, Robinson Oil

How about PADD 4 (Colorado, Idaho, Montana, Utah, Wyoming)?

Phillips 66, Pocatello, Idaho, 04 October 2012.

According to the U.S. Energy Information Agency, the current average retail price for PADD 4 area DSO is $4.20 per gallon. If you notice in the pics I posted, here in Bannock County, Idaho, diesel prices range from $4.30 to $4.40 per gallon, at the cheap fuel stations.

CommonCents, Chubbuck, Idaho, 04 October 2012.

For regular octane gasoline, USEIA says the average PADD 4 area retail price is $3.76 per gallon. My pics show that where I live it’s at least $3.82-$3.84 per gallon.

Padd 4 fuel stockpiles have been stable for all types of gasoline, around 6 million barrels, that’s according to 28 September 2012 data. All types of DSO, in PADD 4 area, has a stockpile of about 3 million barrels, steady for the past four weeks. So stockpile issues do not explain why prices in Idaho are higher than the PADD 4 average.

It’s not production issues either. PADD 4 production has gone up. DSO production at the end of September was averaged at 0.174 millions of barrels per day (mbpd). Last year it was 0.156 mbpd.

PADD 4 gasoline production ended September with an average of 0.296 mbpd. At the same time last year it was 0.254 mbpd.

In fact, even in the troubled PADD 5 area, USEIA data shows stockpiles and production hasn’t changed that much in the past four weeks. (stockpiles of DSO in PADD 5 have actually gone up in the past two months!)

Is it demand? Nope. According to USEIA, overall demand for fuel in the United States has gone down slightly since last year!

Average demand for gasoline was at 8.6 mbpd at the end of September, last year it was 8.9 mbpd. For DSO the average demand was at 3.6 mbpd, compared to last year’s 3.8 mbpd.

The USEIA reported that at the end of September, for the country as a whole, raw oil stockpiles were down by 500,000 barrels. The ‘expert’ media analysts had expected an increase of 1.5 million barrels! Overall stockpiles of gasoline went up by 100,000 barrels. The big loser is DSO, with stockpiles falling by 3.7 million barrels!!! The net result being an overall reduction in petroleum supplies!

Well, if stockpiles and production are steady or actually up in PADD 4 & 5 areas, and demand is slightly down for the country, then why would overall supplies be low?

Blame PADD 1 and 3! Stockpiles and production are crashing on the east coast and in the Gulf states!

At the end of September PADD 1 had 41.1 million barrels of DSO, a 20 million barrel drop from last year’s 61.5 million! Gasoline is at 46.1 million barrels, compared to last year’s 55.3 million barrels!

PADD 3 ended September with 67.4 million barrels of gasoline, last year they had 74.9 million! DSO saw a huge drop, from 50.8 million barrels last year to 37.4 million barrels at the end of September this year!

For such a big drop in stockpiles, PADD 3 averaged DSO production is unchanged from last year, at 2.4 mbpd. PADD 1 DSO production average is down slightly from 0.4 mbpd last year to 0.38 this year.

The same can be said of PADD 1 gasoline production; 2.8 mbpd this year versus 2.9 mbpd last year. Average gasoline production for PADD 3 ended September at 1.8 mbpd, last year it was at 2.1 mbpd, so a big drop there.

This begs the question: Is the western half of the United States being made to pay for shortages that should only be affecting the eastern half of the country?

“I see no reason for this at all. Sounds like a load of rubbish to me!”-Errol Emrich, pissed off California driver

PS: Wholsale/futures/commodity prices for refined fuels ended September 2012 higher. So expect even higher prices at the pump next month! Wish the U.S. petroleum industry a Happy Thanksgiving!

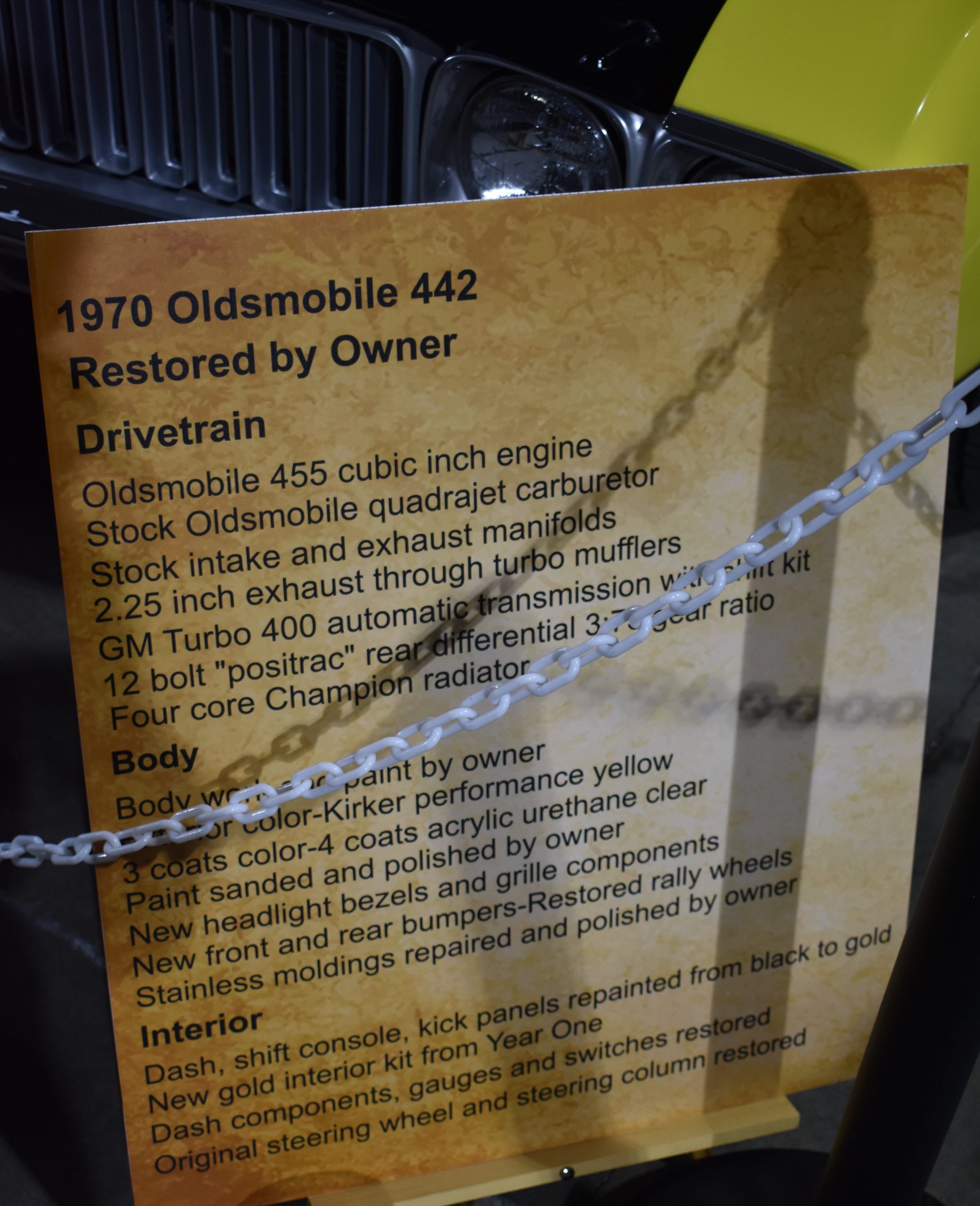

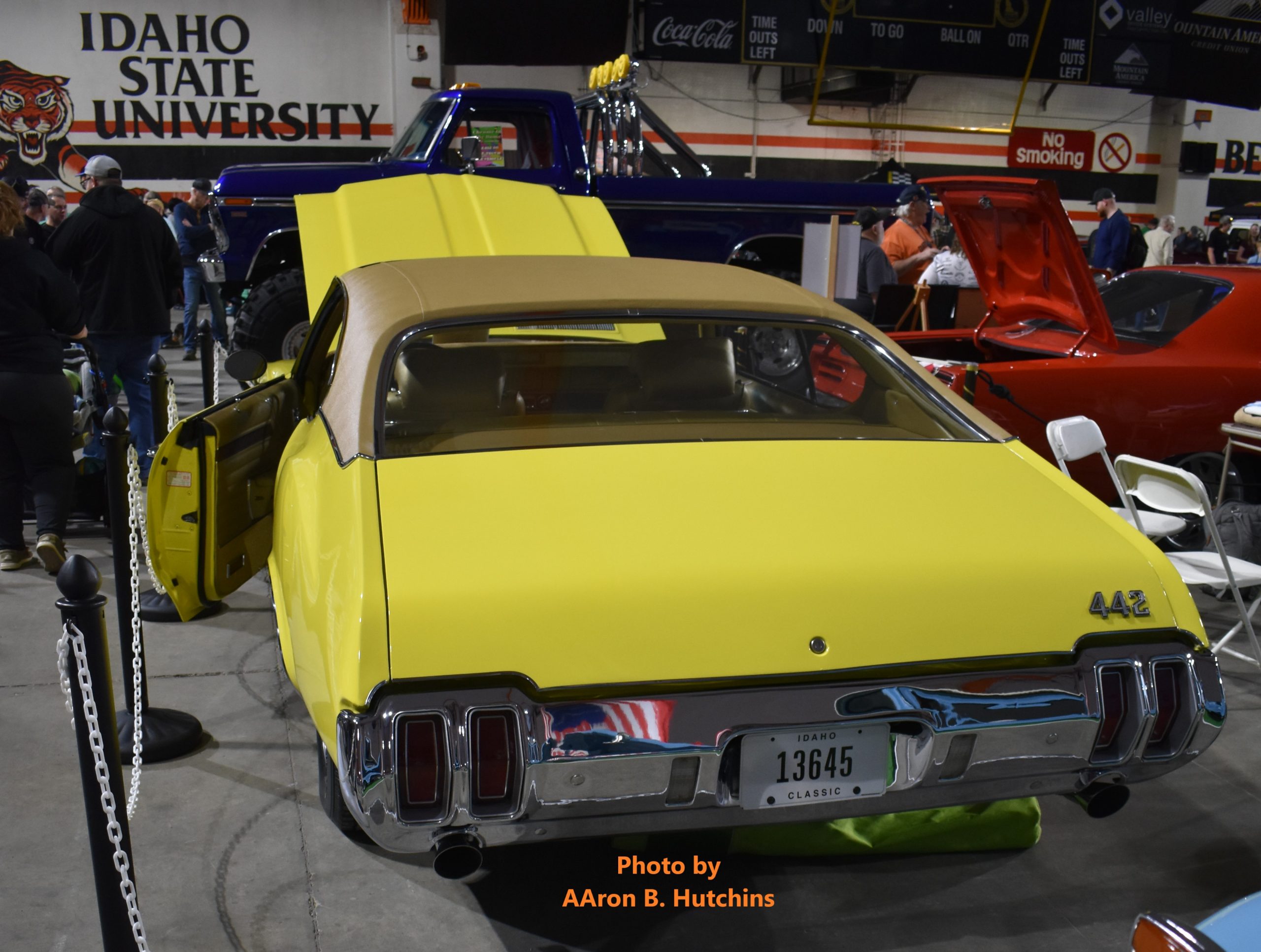

It seems appropriate that this 1970 Oldsmobile 442 decided to make an appearance in a colligate sports arena that first opened in 1970.

It seems appropriate that this 1970 Oldsmobile 442 decided to make an appearance in a colligate sports arena that first opened in 1970. BRITISH BOND BUG

BRITISH BOND BUG