Anybody remember the very recent main stream news media mantra of ‘Deadlier than Delta’? Anybody remember the ancient Greek fable about The Boy Who Cried Wolf?

07 December 2021 (04:42-UTC-07 Tango 06) 16 Azar 1400/02 Jumada l-Ula 1443/04 Geng-Zi (11th month) 4719

InfectionControlToday, 03DEC2021: Omicron May Be More Infectious, Deadlier Than Delta

DNAIndia, 29NOV2021: Omicron more transmissible and deadlier than Delta

ABC News, 26NOV2021:

NationalGeographic, 17SEP2021: Is a variant worse than Delta on the way?

JoyNews, 02SEP2021:

Cedars-Sinai/Newsweek, 24AUG2021: A Doomsday COVID Variant Worse Than Delta

KanakNews, 07AUG2021:

MSNBC, 05AUG2021:

Keep in mind that almost every new variant of coronavirus had initially been labeled as deadlier than the previous variants!

Reuters, 04DEC2021: South African official says Omicron infection is mild, symptoms are flu-like, so far no deaths

The latest data (as of 03DEC2021) out of South Africa is that so far nobody has died from Omicron, and that most people who were hospitalized, were hospitalized for a different medical condition and that it was after hospitalization that they tested positive for Omicron! This is called being “COVID incidental”; you being hospitalized for a non-Pandemic problem and you just happen to be also infected with the Pandemic.

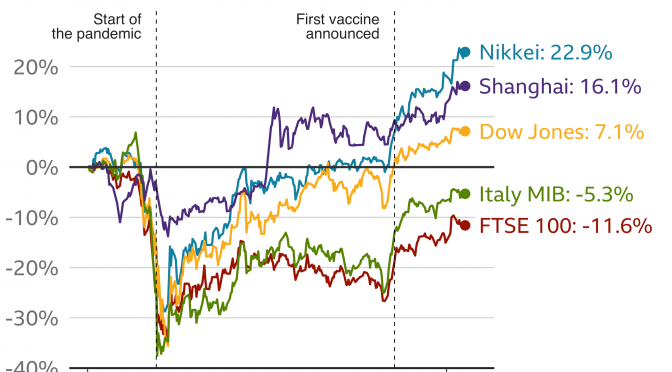

Omicron is more infectious than Delta, but at this point the data shows it is in no way more deadly than Delta! What seems to be the biggest impact of continued news media/government fear mongering over the Pandemic, is economic, and apparently that is the true motive.

France24, 30NOV2021: Omicron variant raises new fears for pandemic-hit world economy

Reportedly, Amin Nasser, Chief Executive Officer of Saudi Arabia’s Aramaco, intimated that the Pandemic news media fear mongering is all about controlling market prices of natural resources! It should be noted that on 06DEC2021, Saudi Arabia used the recent Omicron fear mongering as an excuse to raise their oil prices for January 2021 deliveries!

There are now concerns that one barrel of oil could hit U.S. $150 for 2023!

Reuters, 07DEC2021: Pandemic fear mongering makes the super rich wealthier!

Business Standard, 07DEC2021: International Monetary Fund uses Omicron fear mongering to call for tighter control of world economies!

SouthChinaMorningPost, 07DEC2021: Communist China backs Switzerland based World Trade Organization for the creation of a ‘post-pandemic’ world economy!

Pandemic Perfidy: PRE-PANDEMIC NURSING SHORTAGE WILL LAST UNTIL 2025!

Pandemic Logistics Perfidy:  SKYROCKETING USED CAR PRICES & INSURANCE RATES STARTED YEARS BEFORE THE Pandemic SHORTAGES!

SKYROCKETING USED CAR PRICES & INSURANCE RATES STARTED YEARS BEFORE THE Pandemic SHORTAGES!